Whereas several Ugandans are struggling to access their savings with the National Social Security Fund (NSSF), the managers of the Fund are literally swimming in billions of cash.

Credible sources within this government entity have revealed to this website that top bosses at NSSF are living a very luxurious lifestyle because of the hundreds of billions of shillings they pocket at the end of each month in terms of salaries, allowances, and other emoluments, which include bonuses.

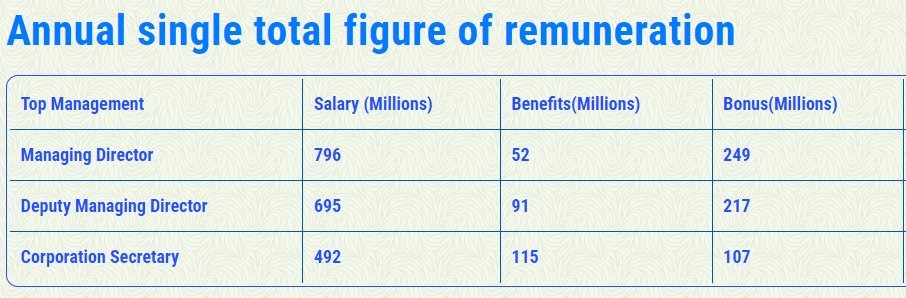

According to information accessed through our sources, the Managing Director Richard Byarugaba earns Shs796M as salary per annum, with Shs52M in benefits and Shs249M as an annual bonus, making a total of Shs1,097Bn.

When it comes to the Deputy Managing Director, who is Patrick Mike Ayota, this one earns a salary of Shs695M, plus benefits of Shs91m and bonuses of Shs217M, totaling up to Shs1,003Bn.

The other high-ranking officer at NSSF who earns big is the Corporate Secretary Margaret Tibayeita Isharaza who bags Shs492M as annual salary, plus Shs115M as benefits and Shs107M as bonuses, hence a total of Shs714M.

It should be noted that NSSF is a quasi-government agency responsible for the collection, safekeeping, responsible investment, and distribution of retirement funds from employees of the private sector in Uganda who are not covered by the Government Retirement Scheme. Participation for both employers and employees is compulsory.

The Uganda National Social Security Fund is the largest pension fund in the countries of the East African community, with assets of over USh15.5 trillion (approx. US$4.406 billion), as of June 2021.

However, the Fund last year objected to a Parliament report proposition to amend the NSSF Act so as to allow savers aged 45 years and above midterm access to their savings amidst a pandemic that saw many jobs lost and businesses close. This is also not the first time the fund has been called out for “fat” pay under the same management as it was reported in 2011, 2017, and 2019. For all the times, management has refuted the reports.