The Uganda National Oil Company (UNOC) is seeking investors to take over oil blocks in the Albertine Graben following the exit of Tullow Oil plc from Uganda’s crude oil exploration projects.

This comes after Tullow Oil announced the proposed sale of its entire stake in Uganda in Blocks 1, 1A, 2 and 3A and interests in the proposed East African Crude Oil Pipeline (EACOP) at USD$575 million (about Shs2,126,385,650)

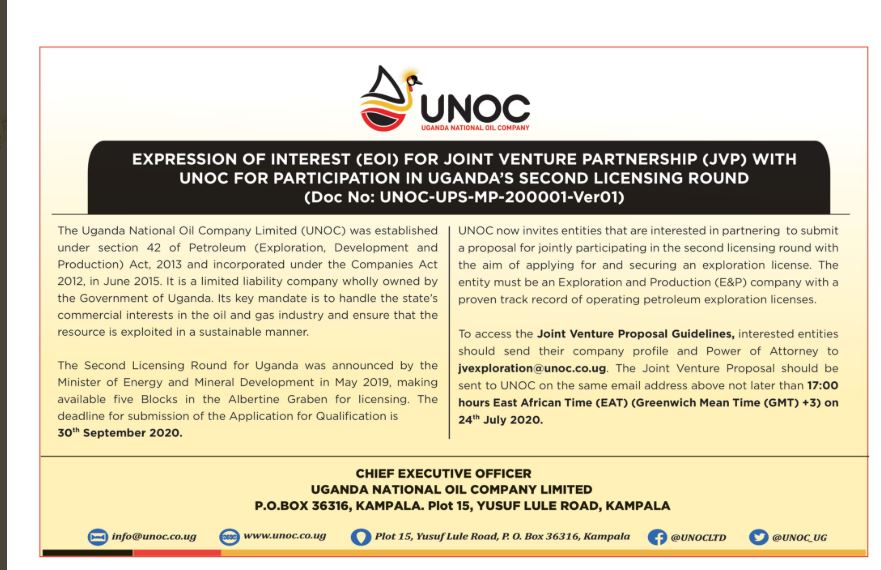

Following the move, UNOC has since announced an Expression of Interest for Joint Venture Partnership, after revealing that there are currently five blocks available for exploration.

A notice issued by the UNOC Chief Executive Officer (CEO) Proscovia Nabbanja last week about this new development reads thus;

Why Tullow Oil Quit

Uganda’s oil sector and the proposed Crude Oil Pipeline suffered a setback after Tullow Oil took a decision to pull out its investment and sell off its stake in Uganda, following longstanding wrangles with the government over taxes, which the company later settled.

Shortly after settling the tax dispute, Tullow Oil stated thus on their website; “Following constructive discussions with the Government of Uganda and the URA, Tullow has agreed to pay $250 million in full and final settlement of its (Capital Gain Tax) CGT liability. This sum comprises $142 million that Tullow paid in 2012 and $108 million to be paid in three equal installments of $36 million.”

Tullow disputed the Uganda Revenue Authority’s assessment of $473 million of CGT payable following the farm-downs, appealed against the assessment before the Uganda Tax Appeals Tribunal (‘TAT’) and commenced an International Arbitration in September 2013.

In July 2014, the TAT rejected Tullow’s appeal and assessed Tullow’s CGT liability for the farm-downs at $407 million less than $142 million previously paid.

In its 2014 accounts, Tullow recorded a contingent liability of $265 million in relation to the dispute. Tullow subsequently appealed the TAT ruling to the Ugandan High Court and continued with its International Arbitration claim. Following this settlement, both these legal proceedings have since been withdrawn.

Consequently, as a result of the standoff between Tullow Oil plc and the Ugandan government, plus other factors in the environment that have made the investment stall for years, Tullow announced on July 18th, 2020 in a statement published on their website that; “Tullow Oil plc (Tullow) announces further to its announcement on 23 April 2020 in relation to the agreed sale of its entire stake in the Lake Albert Development Project in Uganda to Total for US$575 million in cash plus post first oil contingent payments, a shareholder circular relating to the Transaction (the Circular) has been published today, having received approval from the Financial Conduct Authority.”

They added that “Under the UK Listing Rules, the Transaction constitutes a Class 1 transaction and is therefore conditional on, among other things, the approval of Tullow’s shareholders, by a simple majority of votes cast. The Circular contains further details on the Transaction and a notice convening a general meeting of Tullow to be held at the offices of Tullow Oil plc, at 9 Chiswick Park, 566 Chiswick High Road, London W4 5XT at 12 noon (London time) on 15 July 2020 (the General Meeting) to consider and approve the Transaction.”

The statement continues that; “As described in the Circular, the Transaction is of critical importance to Tullow and the Tullow Board unanimously recommends that all shareholders vote or procure votes in favor of the resolution being proposed at the General Meeting.

In light of the social distancing measures aimed at reducing the transmission of the COVID-19 virus in the United Kingdom, please note that attendance at the General Meeting in person is not possible. The General Meeting will be a closed meeting.

Shareholders should not attempt to attend the General Meeting in person. Any shareholders who attempt to attend in person will be refused entry. Shareholders should instead vote in advance by proxy by appointing the Chair of the General Meeting as their proxy in respect of all of their shares to vote on their behalf…”

The statement from Tullow also notes that; “The Transaction also remains subject to a number of other conditions, including customary government and other approvals and the execution of a binding tax agreement with the Government of Uganda and the Uganda Revenue Authority that reflects the agreed tax principles previously announced. Subject to the satisfaction of the conditions, the Transaction is expected to complete in the second half of 2020.”

It should however be noted that Tullow Oil follows Heritage Oil, which quit Uganda’s oil sector a few years ago.

Heritage Oil and Gas Company Ltd, which had earlier on acquired blocks 1 and 3A in the Albertine Graben, had to sell its interests to another company that had resources to extract and refine the oil but did not want to pay taxes on the sale.

Heritage wanted to sell its interest in oil blocks 1 and 3A to either Italian giant ENI spa or Tullow Oil and it was supposed to earn $1.5b from the sale. It ended up selling to Tullow Oil which paid 41.45 billion in cash.

The Government, on the other hand, insisted that Heritage had to pay the capital gain tax amounting to over Shs800 billion.

Heritage Oil sought arbitration with the London-based United Nations Commission for International Trade Law (UNCITRAL), but the case did not end in their favor.